9 Simple Techniques For Estate Planning Attorney

Table of ContentsAbout Estate Planning AttorneyWhat Does Estate Planning Attorney Mean?Rumored Buzz on Estate Planning AttorneyMore About Estate Planning Attorney

A strong estate strategy will certainly shield your properties and permit you to pass on as a lot of your estate as feasible.

It sounds tedious however it is essential to speak with all your capacity lawyers, because estate preparation is an individual process. You will be sharing personal information about your money and your plans for the moment of your death. Having a solid attorney-client connection will make points a great deal easier. For how long have you been exercising? Where were you enlightened in legislation? Exactly how will we contact each other? Will I have the ability to reach you straight or will someone else be my factor of contact? Will you send me updates on my estate plan in the future or is this a single solution? Just how will you bill me (hourly vs set rate), and what is your price? Exist any type of costs not included in that rate? If you're working with an estate legal representative from a large law practice, it is very important to understand if you will work solely with someone.

8 Easy Facts About Estate Planning Attorney Described

Try to chat with people that have actually collaborated with the lawyer, like their clients or also another attorney. Lawyers who are challenging to deal with or who treat individuals badly will likely develop such a reputation promptly with their peers. If necessary, have a follow-up conversation with your possible estate lawyer.

When it pertains to guaranteeing your estate is intended and managed appropriately, employing the right estate planning attorney is necessary. It can be unsafe to make such a huge decision, and it is essential to know what questions to ask them when taking into consideration a regulation firm to handle your estate intending task.

You'll make inquiries about the tools available for comprehensive estate strategies that can be tailored to your one-of-a-kind scenario. Their qualifications for practicing estate planning, their experience with special study jobs connected to your specific job, view publisher site and just how they structure their settlement designs, so you have appropriate assumptions from the outset.

The 25-Second Trick For Estate Planning Attorney

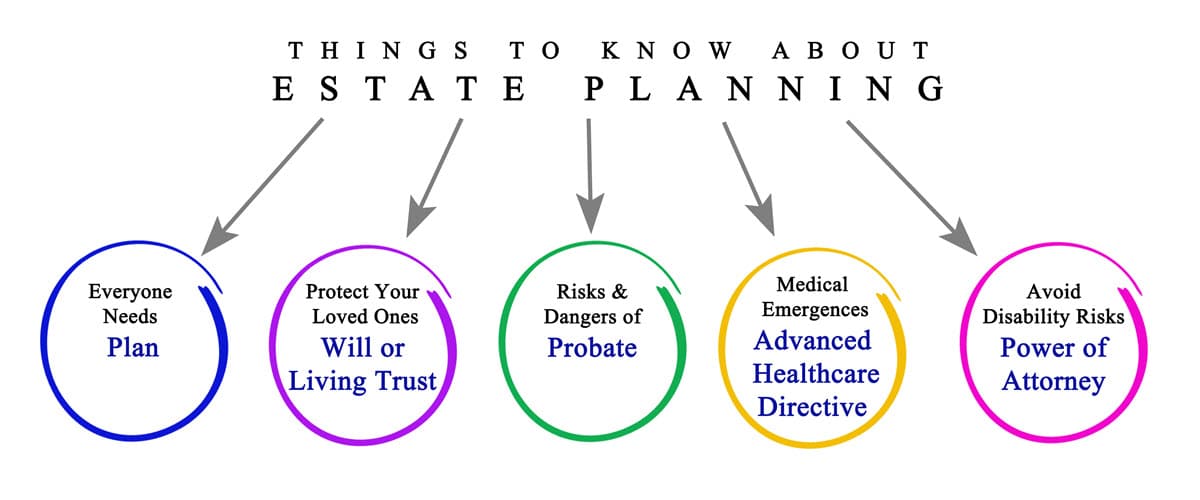

It is important to note that estate preparation records are not just for well-off people; every person must take into consideration contending the very least a fundamental estate strategy in place. With this being stated, it's necessary to comprehend what responsibilities an estate preparation lawyer has to ensure that you can get redirected here locate one that satisfies your one-of-a-kind demands and goals.

This entails aiding the client determine their assets and liabilities and their desires relating to the distribution of those possessions upon death or incapacitation. The estate planning attorney will examine any kind of current files that the customer might have in place, such as wills, counts on, and powers of attorney, to guarantee they are updated with state legislations.

In addition, the estate top article preparation attorney will certainly collaborate with the customer to evaluate their tax obligation circumstance and suggest strategies for lessening tax obligations while likewise achieving the preferred goals of the estate strategy. An estate planning lawyer should be spoken with whenever there are any type of modifications to a person's financial situation or family framework, such as marriage or divorce - Estate Planning Attorney.

With all these duties in mind, it is essential to comprehend what credentials one should try to find when selecting an estate planner. When selecting an estate planning legal representative, it is vital to make sure that they are qualified and experienced. Several estate planning lawyers have actually years of specialized training in the area and experience dealing with clients on their estate strategies.

The 8-Minute Rule for Estate Planning Attorney

Experience and competence are vital when picking an estate preparation attorney, however there are various other factors to consider. Some attorneys may specialize in specific locations, such as elder legislation or company sequence preparation, while others might be more generalists. It is additionally crucial to consider the referrals offered by the attorney and any reviews they have actually obtained from previous clients.

This will allow you to recognize their character and experience degree and ask concerns concerning their technique and method to estate preparation. By asking these inquiries in advance, you will better recognize exactly how each attorney would certainly manage your scenario before dedicating to deal with them on your estate plan. You should ask the ideal inquiries when choosing an estate preparation attorney to guarantee that they are the most effective fit for your needs.

When choosing an estate planning lawyer, it is vital to understand what kinds of solutions they supply. Ask about the attorney's certain estate preparation solutions and if they can develop a customized estate strategy tailored to your requirements. Also, ask if they have experience developing living count on papers and other estate planning instruments such as powers of attorney or health treatment regulations.